As the hotel industry continues to recover and adapt to new market conditions the wake of the pandemic, it’s more important than ever that hotels closely monitor their KPIs to ensure their continued growth and success. Specifically, new technologies have given the hospitality industry new ways to measure and optimize their performance, and use that intelligence to streamline operations and increase profitability.

On the one hand, new technologies are making it possible to measure hotel performance in ways that were previously beyond our grasp. On the other hand, these new technologies are allowing hotel operators to refine how they measure a number of core KPIs that have always been fundamental indicators of how profitable a property is.

Indeed, the more a business can measure, the more it can improve its efficiency, and hotels are now able to quantify and measure KPIs that go beyond the traditional occupancy-based metrics. And these KPIs extend from daily operations to financial performance to marketing and customer service.

Operational KPIs

There are a number of important operational KPIs that can be used to increase the performance and profitability of hotel properties. Indeed, these have to do with properties fundamental overhead, and the more that a hotel monitors them, the more they can increase profitability by reducing their costs.

1. ESG Score

One of the newest of KPIs that are relevant to hotels (and other businesses), ESG stands for “Environmental Social Governance,” and involves adopting a “corporate strategy [that] focuses on the three pillars of the environment, social [inclusion], and [ethical] governance. This means taking measures to lower pollution, CO2 output, and reduce waste” (the environment), as well as committing to a diverse and inclusive workforce from the ground floor (social) all way to the board of directors (governance).

Of course, ESG is about more than just creating a more woke or sustainable hotel operation. It also helps hotels refinance their operations in more efficient ways. For starters, meeting ESG requirements can help hotel operators qualify for advantageous financing products that they can use to reinvest in their properties and gain a competitive edge. Furthermore, the PR value of reaching ESG targets can also attract new investors while also supporting occupancy goals.

Suffice it to say, while ESG Score should not be the be-all and end-all of hotel performance measurement, it is certainly a KPI that hotels should monitor if they are to secure their long-term success. After all, environmental regulations are likely to only continue to expand, and maintaining a competitive ESG Score will help hotel operators stay ahead of the curve, and prevent incurring the inflates costs of having to retrofit their infrastructure on short notice to meet new regulatory requirements.

2. Energy Management

For the hotel industry, “keeping the lights on” extends to a lot more than just, well, lighting. As Forbes reports:

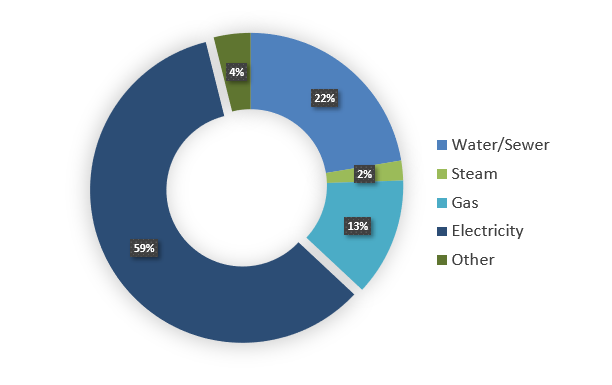

The average U.S. hotel spends $2,196 per room in energy costs each year, which adds up fast. Collectively, the hospitality industry spends $3.7 billion annually on energy. For individual hotels, 60-70% of utility costs are exclusively billed for electricity.

Heating, ventilation and air conditioning (HVAC) alone is responsible for 40% of hotel electricity usage.

Fortunately for the hospitality industry, a variety of energy management technologies now make it possible to not only monitor energy consumption with the utmost accuracy, but adjust and optimize energy consumption in response to real-time consumption patterns.

Source: CBRE Hotels Research, Trends in the Hotel Industry

Specifically, IoT energy management devices now allow hotels to both use their HVAC systems more efficiently and save significantly on their energy consumption and costs. While smart thermostats and occupancy sensors monitor and respond to real-time fluctuations in occupancy, smart energy management systems like Verdant EI use sophisticated machine learning algorithms to continuously analyze historical thermodynamics, local weather patterns, and peak demand loads to optimize energy consumption in real-time, all year round.

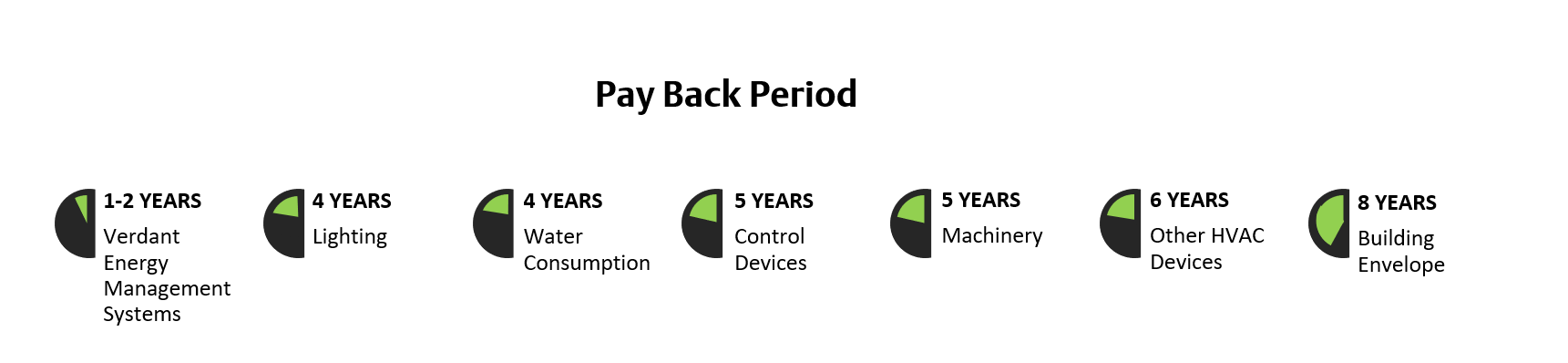

Indeed, using smart energy management systems to monitor and optimize energy consumption can reduce hotel energy costs by up to 20%, and generate some of the fastest payback periods in the industry (between 12-24 months). The ROI is so significant, in fact, that it will increase the resale value of your hotel.

3. Water Consumption

Energy isn’t the only consumption-based KPI that hotels should be monitoring. Whether it’s for guest rooms, pools, sanitation, or food/beverage service, water is also an unavoidable cost of doing business in the hospitality industry, and represents a significant component of overhead that can and should be managed carefully. Indeed, “Water and Sewer costs are the 2nd largest utility expense for hotels topping off at almost 25% of all utility costs.”

[A]ccounts for about 15 percent of total water use in US commercial and institutional facilities, according to the EPA … [And some] estimates suggest that implementing water-efficient practices in commercial buildings can decrease operating costs by approximately 11 percent and energy and water use by 10 and 15 percent, respectively.

For this reason, many hotels now use IoT-enabled devices to conserve water and prevent water-related damage. Just consider how a single leaky toilet can cost as much as $840/year. Add to that the cost of any additional water damage, and water waste can quickly become unnecessarily expensive. By monitoring water lines with smart, low-cost IoT-enabled water meters, however, hotels can see an ROI on their water consumption in about 4 years.

4. Labor Costs as % of Sales

Of course, another major part of any hotel’s overhead is labor. After all, once the lights are on and the water’s running, a hotel still requires staff to manage bookings, clean rooms, and perform any number of services that are considered a fundamental part of any guest experience.

Indeed, labor is traditionally one of the costliest overhead inputs, so this KPI is crucial to the healthy operation of any hotel. By monitoring overall labor expenditures versus revenue, hotels can avoid over-staffing during slow seasons, days, or shifts.

5. Employee Performance

Labor costs, of course, aren’t just limited only to employee salaries. There are also the hidden costs of employee performance. In other words, there’s how much a hotel pays for each unit of labor, and then there’s how much value it gets from each of those individual units. This is why:

Effective performance evaluations can be tremendously beneficial for your staff. […] This feedback assists them in their short- and long-term career goals, and improves the overall performance of your hospitality business.

After all, a big part of maximizing the ROI of a hotel’s staffing decisions is understanding not only the optimal number of staff to have on hand at any given time, but also the optimal output for each of those staff members.

6. Employee Turnover

A final operational KPI that hotels need to measure and monitor is employee turnover. After all, onboarding new employees comes with hidden costs associated with their training and management.

For starters, the time an employee spends in training is characterized by lower output and productivity, meaning that hotel operators are paying more per hour for lower output. Furthermore, the time managers spend training a new employee is time lost that they could’ve spent doing something else. As DailyPay puts it:

The average 2021 turnover rate in the leisure and hospitality industry [was] 84.9% compared to the overall rate of 47.2% nationally. Hospitality companies can work to reduce turnover and increase retention rates to improve guest experience and reduce unnecessary hiring and onboarding costs associated with replacing employees.

High turnover rates among hotel and hospitality staff may have damaging effects on a team’s morale, reduce the company knowledge base, interfere with customer service, and burden remaining staff.

In sum, onboarding and training new employees represents a significant cost center for hotel operators, and reducing that turnover can help significantly increase hotel profitability. And by measuring turnover and its related costs, hotel operators can get a better sense of where employee churn is occurring the most, and take measures to reduce it.

Financial Performance

Operational KPIs, of course, are only part of the picture. At the end of the day, hotels must also closely monitor a range of financial KPIs to ensure that they’re maximizing profitability. Indeed, metrics relating to sales, revenue, and occupancy rates should all be monitored and analyzed to help hotel operators optimize business performance across the board.

7. ADR – Average Daily Rate

Average Daily Rate (or ADR) is a KPI that hotels can use to measure and calculate their profitability. It provides insight into the average rate a room can earn on any given day during any given period. It’s also particularly useful for demand forecasting and predictive marketing. Indeed, ADR helps hotels predict seasonal trends, adjust their pricing accordingly, and maximize revenue per room.

8. ARI – Average Rate Index

The Average Rate Index (ARI) is a hotel KPI that compares Average Daily Rate (ADR) with the property’s competitive set for a given period of time. A property’s competitive set, moreover, is comprised of other brands and competitive properties who are targeting similar markets and/or market segments. The competitive set (comp set) is obtained by calculating the Average Daily Rate (ADR) for a group of competitors, and if a property’s ADR is equal to the aggregate ADR of its competition, it is historically believed that the property is achieving its “fair market share”.

9. ARR – Average Room Rate

Similar to ADR, the Average Room Rate (or ARR) is a hotel KPI that averages out the rate that hotel is charging per available room. The main difference between ADR and ARR is that while ADR measures the average rate on a daily basis, ARR can be used to measure the average room rate over longer periods of time (such as weekly or monthly periods).

| The formula for calculate ARR: Total Room Revenue (for a period) / Total Rooms |

10. CPOR – Cost per Occupied Room

Another way to monitor and manage costs at the room level is through Cost per Occupied Room (or CPOR). This KPI helps calculate the average cost per occupied room, and helps hotel managers and operators evaluate whether the operating cost for any give room is reasonable.

| The formula for calculate CPOR: Total Rooms Departments Cost / Number of Rooms sold |

On the cost side of the hotel management equation, moreover, CPOR is one of the most important hotel KPIs. The lower a hotel’s CPOR, then, the higher its other hotels KPIs , including GOPPAR, PROFPAR, and RevPAR (see below for more on these).

11. EBITDA – Earnings Before Interest, Taxes, Depreciation, and Amortization

EBITDA is an acronym that stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, and is particularly useful for revenue managers to compare hotel profitability against competitors or sister properties. Specifically, it’s used to analyze the profits of the products and/or services sold at a hotel property, and is sometimes used as a more reliable calculation for profitability in place of simple earnings or net income.

| EBITDA can also be calculated in one of two ways: (1) by subtracting expenses from revenue, but this does not include interest, taxes, depreciation, and amortization, or (2) by adding net income, interest, tax expenses, and depreciation and amortization together. |

12. GOP – Gross Operating Profit

At the highest level of a hotel’s financial performance is Gross Operating Profit (or GOP). Simply put, GOP is a KPI that measure a hotel’s profits after all operating expenses have been subtracted.

| The formula for calculating GOP is simple: Gross Operating Revenue – Gross Operating Expenses |

GOP is great for getting a quick, birds eye view of a hotel’s financial performance. However, when you want to understand why its performance might be fluctuating (or what can be done to improve it), hotel managers can go a few layers deeper into more specific aspects of a hotel’s financial performance.

13. GOPPAR

GOPPAR, or Gross Operating Profit per Available Room, provides even greater insight into the actual performance of a hotel than GOP or even RevPAR (more on this KPI below) because it factors in not only revenues generated, but also the operational costs incurred to generate those revenues.

| GOPPAR is calculated by subtracting operating expenses from gross revenue to calculate Gross Operating Profit, and then dividing that GOP by the total number of rooms available per year. |

Consequently, GOPPAR measures how revenue compares to a hotel’s operational performance. This means it considers expenses like utilities, labor, F&B costs, and any other revenue from the hotel’s many moving services.

14. Market Penetration Index (MPI)

Not relevant only to the hotel industry, Market Penetration Index (MPI) is a KPI that the hotels use as a performance metric to measures its occupancy rates compare to those of its competitors. Specifically, it compares a hotel’s average occupancy rate to the average occupancy rate of similar hotels in similar markets.

MPI allows hotel managers to analyze a property’s performance based on industry standards as well as competitors, and assess whether their occupancy rate is above, below, or near average for its market.

Consequently, MPI is very useful in setting room rates. Understanding how you stack up against industry averages will allow you to set more competitive prices to maximize occupancy rates. MPI can also be calculated against specific competing hotels rather than just industry averages, allowing hotel managers to get more competitive within particular market segments.

15. Marketing ROI

Department store magnate John Wanamaker is famous for having once said “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.” Fortunately for hotels (and other businesses), we now live in a digital age where most (if not all) of our marketing efforts can be tracked, measured, and quantified.

If anything, because it’s now possible to track, measure, and quantify marketing spend, it’s more important than ever that hotels do so. And by tracking marketing spend against other KPIs, hotels can determine which methods do and don’t work, and therefore which ones to continue to invest in.

16. NRevPAR – Net Revenue per Available Room

Similar to RevPAR (see below), Net Revenue per Available Room (or NRevPAR) monitors booking revenue, but at a more granular level by factoring in the net revenues. In other words, it accounts for transaction fees, distribution costs, travel agency commissions, etc. To this effect, NRevPAR is somewhat of a more transparent KPI because it adjusts for the costs of incurring bookings.

| The formula for calculate NRevPAR: (Room Revenue – Distribution Costs) / Available Rooms |

NRevPAR is an essential KPI for hotel owners and revenue managers, and affords them the insight they need to forecast and plan strategically. It can be challenging, however, to calculate all the different of commission paid to third parties, and transaction and distribution costs.

17. Occupancy Rate

Simply put, “Occupancy rate is the ratio of rented or used space to the total amount of available space.” And for the hospitality business, that means the percentage of available rooms over a specific period of time.

It’s also going to be one of the most important hotel KPIs available because it provides (1) a high-level overview of a hotel’s occupancy performance, and (2) provides context through which other KPIs can be understood. For example, hotels still incur some operation costs for unoccupied rooms. Consequently, comparing Occupancy Rate with Average Daily Rate and costs of room operations allows revenue managers to make decisions that increase a hotel’s overall profitability.

18. Profit Per Available Room (PROFPAR)

Profit Per Available Room (PROFPAR) is a hotel KPI that measures hotel profit earnings for each available room on the property. And because it’s calculated using operating profit, it accounts for changes in room revenue and operating expenses.

For hotel owners, PROFPAR is a reliable metric for evaluating sales growth and management’s ability to control operating expenses. In fact, many hotels sue PROFPAR to assess the profitability of group sales, and be used to assess whether to accept a group booking based on average ancillary spend on other hotel features, services, or amenities.Consequently, PROFPAR is a more popular KPI amongst chain hotel operators because it is an effective metric for assessing whether or not a specific property generates its share of profit. It also helps revenue managers determine whether to compromise their Average Daily Rate (ADR) for a more lucrative group booking at a lower daily rate.

19. Revenue per Available Room (RevPAR)

Revenue Per Available Room (or RevPAR) helps hotels measure the efficiency of their operations by tracking how well they’re filling available rooms at their Average Daily Rate (ADR), as well as plan for the high and low seasons. And since RevPAR measures revenue made during a certain period of time, it can be used to compare any given time period against previous periods, and measure the long-term performance of a property.

RevPAR can be calculated in one of two ways: either “by multiplying a hotel’s average daily room rate (ADR) by its occupancy rate, [or] by dividing a hotel’s total room revenue by the total number of available rooms in the period being measured.”

Of course, this number will fluctuate according to seasonality, economic climate, and consumer trends, which can make it difficult to track. But RevPAR remains crucial to understanding the success and profitability of a hotel property at any given time of year. Indeed, it’s incredibly useful for planning and preparing for both high and low seasons.

20. Revenue per Occupied Room (RevPOR)

Another variant of RevPAR is Revenue per Occupied Room (or RevPOR). This KPI differs from RevPAR, however, in that it only takes into consideration occupied rooms, and consequently provides a better understanding of how much profit a hotel makes from the actual guests staying at a property.

The formula for calculate RevPOR: Total Revenue* / Total Occupied Rooms *Total Revenue = Accommodation + Bar + Room Service + Breakfast + Spa + Bar + Mini Bar + [Additional Revenue] |

With RevPOR, moreover, hotels can also track returns from other departments (apart from rooms), such as food, beverage, spa treatments, and other addons and upsells. In a nutshell, RevPOR offers hotel operators insight into how successful they are once a guest actually checks into the property, which is critical for evaluating a property’s overall performance.

21. Total Revenue Per Available Room (TRevPAR)

Total Revenue Per Available Room (TRevPAR) is a hotel KPI that take RevPAR a step further by accounting for all revenues generated over all departments (such as food, beverage, and spas, etc.). In this way, it differs from RevPAR by accounting for more than the revenue generated only by rooms sold.

TRevPAR is often used as a benchmarking tool for all-inclusive hotels and resorts. It is a more inclusive metric than RevPAR because it can effectively measure how a hotel is using its space to generate revenue. It also allows managers to see how a hotel is generating revenue regardless of whether or not rooms are sold.

Guest Experience KPIs

As crucial as it is that hotel’s measure their financial KPIs, it’s also important that they track and measure the metrics that help generate revenue in the first place. — i.e. the guests. Specifically, guest experience represents a critical set of KPIs because they help determine whether guests are likely to book in the first place, or even become repeat customers.

22. Online Rating

Since we live in the digital age, hotels aren’t the only ones who can track (some) elements of a property’s performance. As customers share their hotel experience online, hotels and their potential guests are able to track how well a property delivered on different guest experience metrics.

For this reason, hotels should monitor their online ratings and reviews very closely, and use that feedback to improve both their operational procedures and guest experience standards. Indeed, online reviews not only provide a source of direct feedback from guests so hotels can adjust their services to meet guest expectations, but they can (and will) impact a property’s bottom line as they affect future bookings.

23. Customer Satisfaction

Of course, the challenge with online ratings is that (1) they only appear after a guest’s visit, and (2) many guests will never leave one at all. Consequently, they don’t provide a complete picture of guest experiences.

This is why guest experience KPIs should be supplemented by customer surveys. As Hotel Tech Report points out, “guest satisfaction scores quantify how guests feel about staying at your hotel. Some hotels rely on guest review scores from sites like Tripadvisor, Google, Expedia, and Booking.com, which show average review scores on a scale from 1 to 5 (or 1 to 10 on Booking.com). Other hotels might use an internal guest sentiment tool, such as TrustYou, to gather their own data about guest satisfaction. Either way, guest satisfaction scores provide valuable intelligence about what your hotel is doing well and which areas have room for improvement.”

24. Loyalty Programs

There’s no business-like repeat business, and for hotels, the feedback that returning guests can offer through loyalty programs can provide valuable (and actionable) insight into a property’s guest experience and how it affects a hotel’s ongoing revenue performance. As iDashboards puts it:

From tracking repeat customers to tracking the value of their purchases, there are several KPIs you can use to measure the success of loyalty programs. If your loyalty program isn’t meeting the goals and objectives you had for it from the outset, revamp it to be ROI driven and more enticing.

In other words, loyalty programs can help hotels can measure the guest experience of their most valuable customers, helping to optimize guest experience and secure revenue through future repeat visits.

Measure, Manage, Optimize, Repeat…

As the renowned American engineer, statistician, professor, and management consultant W. Edwards Deming once said, “Without data, you’re just another person with an opinion.” And that couldn’t be more true than for a business, especially in the hospitality business.

We have so many preconceptions of what impacts our business and our bottom line, but until we start measuring relevant KPIs, it’s all just speculation. For hotels, these KPIs will range from operations to finances to guest experience, and we’re fortunate enough to live in a time where the technology to track and measure these performance indicators is readily available.

So it’s more important than ever, then, that hotels take stock of the KPIs available to them, and implement the processes necessary to monitor and extract insight from them. Indeed, doing so will often mean the difference between a profitable property, and one that often hovers near the line between the red and the black.